More About Medicare Graham

More About Medicare Graham

Blog Article

The Ultimate Guide To Medicare Graham

Table of ContentsSome Ideas on Medicare Graham You Need To KnowThe 8-Minute Rule for Medicare GrahamThe 10-Minute Rule for Medicare GrahamThe Facts About Medicare Graham RevealedMedicare Graham Fundamentals ExplainedExamine This Report on Medicare GrahamThe 3-Minute Rule for Medicare GrahamOur Medicare Graham Ideas

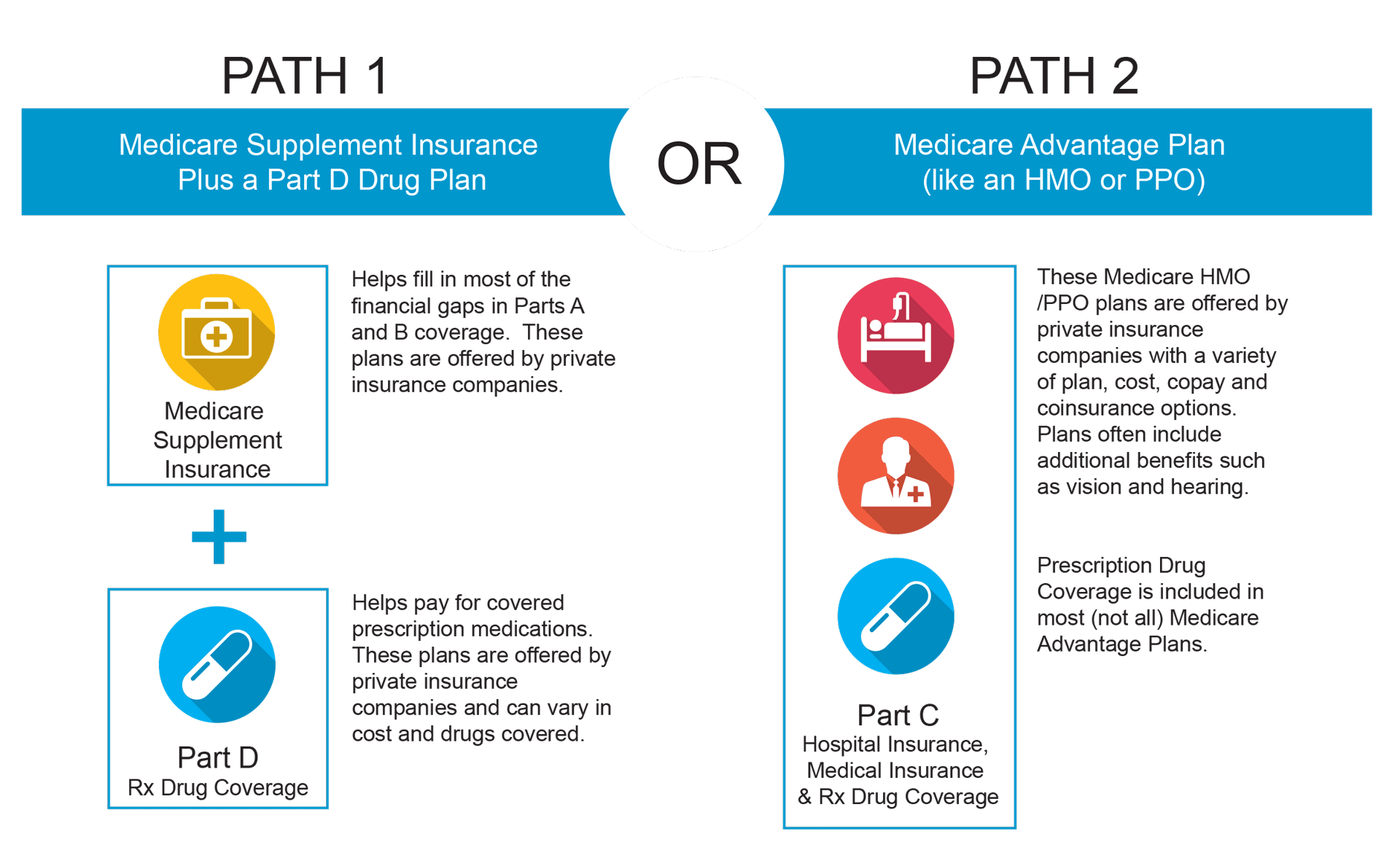

In 2024, this limit was established at $5,030. When you and your plan invest that amount on Part D drugs, you have entered the donut opening and will certainly pay 25% for medicines going onward. When your out-of-pocket costs get to the 2nd threshold of $8,000 in 2024, you run out the donut hole, and "catastrophic protection" begins.In 2025, the donut hole will be mostly gotten rid of for a $2,000 restriction on out-of-pocket Part D medication investing. As soon as you hit that threshold, you'll pay nothing else out of pocket for the year. If you just have Medicare Components A and B, you could consider auxiliary exclusive insurance policy to help cover your out-of-pocket costs such as copays, coinsurance, and deductibles.

While Medicare Component C works as an alternative to your original Medicare plan, Medigap functions with each other with Components A and B and aids load in any type of protection gaps. There are a few important points to learn about Medigap. You need to have Medicare Components A and B before buying a Medigap plan, as it is a supplement to Medicare and not a stand-alone policy.

Medicare has evolved over the years and now has 4 parts. If you're age 65 or older and obtain Social Safety, you'll automatically be enrolled partly A, which covers hospitalization costs. Components B (outpatient solutions) and D (prescription drug advantages) are voluntary, though under particular situations you may be automatically signed up in either or both of these too.

Excitement About Medicare Graham

, depending on exactly how many years they or their partner have paid Medicare tax obligations. Private insurance companies market and administer these policies, but Medicare should authorize any type of Medicare Benefit strategy prior to insurance companies can market it. Medicare does not.

typically cover Commonly %of medical clinical, prices most plans the majority of strategies call for to individual a fulfill before Insurance deductible prior to for medical servicesClinical

Medigap is a single-user plan, so partners have to purchase their very own coverage. The expenses and advantages of different Medigap plans depend upon the insurance coverage business. When it involves valuing Medigap strategies, insurance policy carriers may make use of among several methods: Premiums coincide regardless of age. When an individual begins the plan, the insurance provider factors their age right into the premium.

An Unbiased View of Medicare Graham

The insurance company bases the original premium on the individual's current age, however premiums rise as time passes. The rate of Medigap plans varies by state. As noted, prices are lower when an individual buys a plan as quickly as they get to the age of Medicare eligibility. Specific insurance policy companies might additionally offer price cuts.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance coverage. The time may come when a Medicare plan owner can no longer make their own decisions for factors of mental or physical health and wellness. Prior to that time, the person needs to designate a relied on person to offer as their power of attorney.

The individual with power of attorney can pay costs, file taxes, gather Social Protection benefits, and choose or alter medical care plans on part of the insured individual.

The smart Trick of Medicare Graham That Nobody is Discussing

Caregiving is a requiring task, and caretakers often invest much of their time meeting the requirements of the individual they are caring for.

Depending on the specific state's regulations, this may include working with relatives to offer care. Given that each state's guidelines vary, those seeking caregiving payment should look into their state's requirements.

The Medicare Graham Statements

The insurance company bases the initial premium on the individual's current age, but premiums rise as time passes. The price of Medigap intends varies by state. As kept in mind, rates are reduced when a person gets a plan as quickly as they get to the age of Medicare qualification. Individual insurance provider may likewise offer discounts.

Those with a Medicare Advantage strategy are ineligible for Medigap insurance. the original source The moment might come when a Medicare plan owner can no more make their very own decisions for factors of mental or physical wellness. Before that time, the individual must designate a trusted individual to act as their power of lawyer.

The Definitive Guide for Medicare Graham

The individual with power of lawyer can pay costs, file taxes, gather Social Protection benefits, and choose or alter medical care plans on behalf of the guaranteed individual.

A launch kind notifies Medicare that the insured person enables the named individual or team to access their clinical information. Caregiving is a demanding job, and caregivers frequently invest much of their time meeting the requirements of the person they are looking after. Some programs are readily available to give monetary aid to caregivers.

Report this page